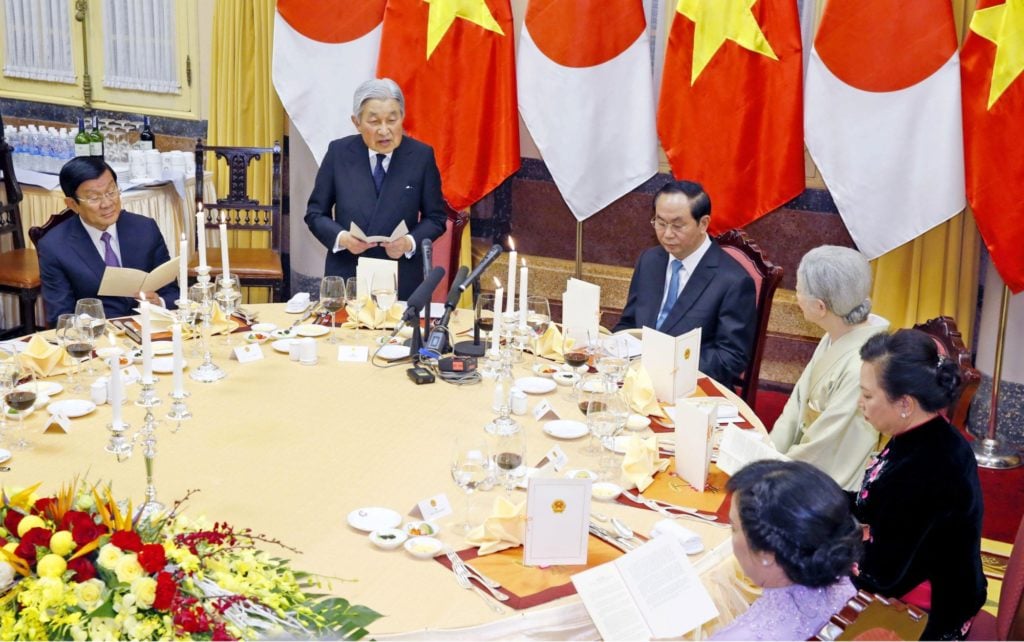

Emperor Akihito speaks at a banquet sponsored by Vietnam President Tran Dai Quang in Hanoi in early March. | POOL / VIA KYODO

Much ink has been spilled over Chinese President Xi Jinping’s Belt and Road Initiative, following his hosting of a forum dedicated to the idea back in May. While it still is early days for the initiative, the forum was successful in bringing together leaders from 28 nations and delegates from more than 100 countries, including prominent members from both the public and private sector.

Xi’s $1 trillion initiative, formally called “The Silk Road Economic Belt and the 21st-century Maritime Silk Road” and mercifully shortened to “One Belt, One Road” (OBOR) or the “Belt and Road Initiative” (BRI), intends to mimic the ancient silk road trade routes connecting China with European markets by building roads, highways, ports and pipelines.

Yet amongst all the fanfare surrounding OBOR, similar efforts by other countries seeking to spread political influence in Asia may go unnoticed. In part a reaction to China’s establishment of the $100 billion Asian Infrastructure Investment Bank (AIIB), Japanese Prime Minister Shinzo Abe’s $110 billion “Partnership for Quality Infrastructure” (PQI) initiative in May 2015 will also help meet infrastructure needs in Asia. Increased to $200 billion last year, the PQI will partner with the Japanese-led Asian Development Bank (ADB) to fund “quality infrastructure investment in Asia”. As noted, the PQI intends to differentiate itself from the AIIB by focusing on quality, as Abe alluded to during his announcement of the PQI: “In order to make innovations extend to every corner of Asia, we no longer want a ‘cheap, but shoddy’ approach”.

Japan’s reputation for quality infrastructure is well-known in Asia, where Tokyo is hitting back at Beijing’s efforts at economic hegemony with promises of sorely-needed advanced water treatment, energy-saving technology and high-speed rail. Examples of high-quality infrastructure built by the Japanese includes the Delhi Metro in India, Ulan Bator’s railway flyover in Mongolia, and Hanoi’s Nhat Tan bridge in Vietnam. In Southeast Asia, Tokyo announced a three-year $6.1 billion dollar aid package for five Mekong countries in July 2015, including Vietnam.

In June, Vietnamese Prime Minister Nguyen Xuan Phuc travelled to Tokyo for the Conference on Business Promotion into Vietnam to oversee the signing of some $22 billion in business deals in urban development, transport and infrastructure. Phuc referred to the conference as “historic,” adding “Everyone present today, at this conference hall, is considered Vietnam’s close friend.”

As Vietnam’s largest foreign investor ($19.2 billion in the first half of 2017), largest source of official development assistance (ODA), third largest tourism partner and fourth largest trade partner, Japan has tremendous economic influence in Vietnam. By the end of 2016, Japan had more than 3,200 investment projects in Vietnam with total registered capital of more than $42 billion, including the $2.8 billion Nghi Son 2 thermal power plant in Thanh Hoa Province and the landmark Ho Chi Minh City Metro system, for which the Japanese government has pledged $2.2 billion in official development assistance.

In sharp contrast, China does not even feature in the top foreign investors in Vietnam, falling behind other regional players South Korea, Japan, Singapore and Taiwan. Part of the reason may be due to historical mistrust – the Vietnamese have a long history with China, having been ruled by its northern neighbor for more than a millennium. More recently, the two nations fought a devastating, but short battle in 1979 when Chinese troops crossed the northern border to punish the Vietnamese for their invasion of Khmer Rouge-led Cambodia in December 1978. In 1988, the Vietnamese lost 64 sailors after Chinese forces exerted control over the Paracel Islands, which Vietnam also claims. Tempers again flared in May 2014, when China National Offshore Oil Corporation moved its $1 billion Haiyang Shiyou 981 offshore oil rig into Vietnam’s exclusive economic zone. The move led to anti-China riots near foreign-invested factories in central and southern Vietnam, and demonstrations in several cities.

Given such a long history of animosity, there exists a substantial bank of distrust among Vietnamese toward Chinese investment. The Chinese have been accused of using Vietnamese front companies to purchase coastal land in Da Nang, and food thought to originate from China is widely suspect among many Vietnamese.

Japan is viewed most favorably by Asian populations, except in China and South Korea given historical animosities, according to a recent poll by the Pew Research Center.

Vietnamese have the second highest favorable opinion of Japan (82%) among Asians after Malaysians (84%), while the number of Vietnamese holding favorable opinions of China (19%) is the second lowest in Asia, after the Japanese (9%). Almost half the Japanese (49%) express a very unfavorable view of China.

This soft power cultivated by the Japanese, and shared dislike of China, may explain the business opportunities which have opened for Japanese companies in Vietnam. And with the introduction of Tokyo’s Partnership for Quality Infrastructure, Japan’s rival to China’s OBOR, future battles will hopefully be fought in boardrooms and not on the high seas.