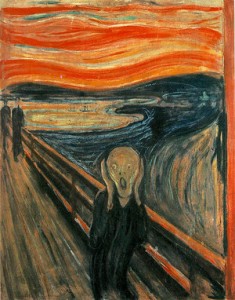

AIG Executives have been given huge bonuses with taxpayer money, and everyone is furious. AIG claims that they have contractual obligations which predate the largest private sector bailout in history. Politicians say these obligations are secondary to satisfying taxpayers who are keeping them above water. Pundits, smelling blood in the water, have come out in force to grind their axes with issues ranging from from the outrage of international capital mobility to defenses of laissez-faire capitalism unfettered by government intervention. Everyone has taken this as an opportunity to hop up on the soap box.

Sen. Charles Grassley (R-IA) says:

“I would suggest the first thing that would make me feel a little better toward them [AIG executives] is if they follow the Japanese example and come before the American people and take that deep bow and say, ‘I am sorry,’ and then either do one of two things: resign or go commit suicide, and in the case of the Japanese, they usually commit suicide.”

Here’s the story behind the noise, as I see it.

What Did AIG Do Wrong?

Over the last several years, they sold lots and lots of Credit Default Swaps, without putting up any collateral. They weren’t required to put up collateral because they were Triple A rated by Moody’s and S&P. They were Triple A rated because they are an enormous, old company with a sound business model: selling insurance. They weren’t re-rated when they started CDS’s because the CDS’s appeared to be a small part of their overall business. They appeared to be a small part of the balance sheet because accounting standards were differently applied than they were to other sorts of insurance. It also seems likely that the ratings agencies were complicit. Accounting standards were uneven due to the same piece of legislation, the Commodity Futures Modernization Act, which allowed the Enron fiasco to happen.

Who’s to blame here? AIG, the ratings agencies, regulators, independent accountants and risk managers, not to mention the actual buyers of these massive quantities of CDS’s all seem to have more or less culpability. Essentially everyone. AIG was just the first to crack.

So Why Did The Feds Bail Them Out?

In early September AIG finally got downgraded by the ratings agencies, and it became immediately clear that they did not have the funds to back up their obligations. Now, the preposterous CDS system collapsing due to AIG’s default would itself have been terrible, but AIG is also a normal insurer, responsible for a variety of commercial and industrial insurance and reinsurance which are vital for the continued functioning of the global economy. The bailout gave the U.S. government 80% control over the company, rendered the stock virtually worthless, and charged a punitive interest rate of 8.5% plus LIBOR (About 10% total right now.) That is an inescapable debt if ever one existed. It was never intended to keep the company afloat indefinitely, merely manage the continuity of its obligations while it was dissolved in an orderly fashion.

So How Can We Let Them Steal Our Money Like That?

Continuity of obligations is a key concept here. Just like AIG is obliged to pay you if you get in a car accident or your supertanker sinks, they are likewise obliged to pay the bonuses they agreed to last year. Because, for reasons that are unclear, proper bankruptcy proceedings have not been initiated, and having not officially entered into receivership, their obligations are still valid, both internal and external.

And that’s the question I haven’t seen any of the grandstanding politicians have even pretended to try to answer. Why hasn’t this been handled as a dissolution? Why is AIG still allowed to behave as though it’s a going concern? There was a legal, systematic way to go about fixing this, and it was not pursued. That’s a shame, because if Obama and Geithner personally reach in now and grab the checks out of the hands of the executives, it will damage the sanctity of legal structure in a way that will take a long time to repair. It will also, in its own way, reflect an idea of executive privilege comparable to the Bush Presidency, the abolition of which was one of Obama’s campaign promises.

It is not the role of the executive branch to ride roughshod over private sector contracts, taking money from the wicked and giving it to the virtuous. So as much as I hate to see the greedy, stupid executives of AIG profit off of the misery they helped to create, at present I don’t see any better alternative. Suggestions?