It's official: Kashagan oil extraction work has been shut down pending new negotiations with the consortium led by independent oil company ENI. This is not affecting anyone's current oil supply, but it will be of interest to world stockbrokers, oil-market analysts, and Central Asia watchers. I love this stuff, myself, so Let's Go: this is a long post, but painless and (hopefully) entertaining. You will be fully informed by the end.

It's official: Kashagan oil extraction work has been shut down pending new negotiations with the consortium led by independent oil company ENI. This is not affecting anyone's current oil supply, but it will be of interest to world stockbrokers, oil-market analysts, and Central Asia watchers. I love this stuff, myself, so Let's Go: this is a long post, but painless and (hopefully) entertaining. You will be fully informed by the end.

Some history:

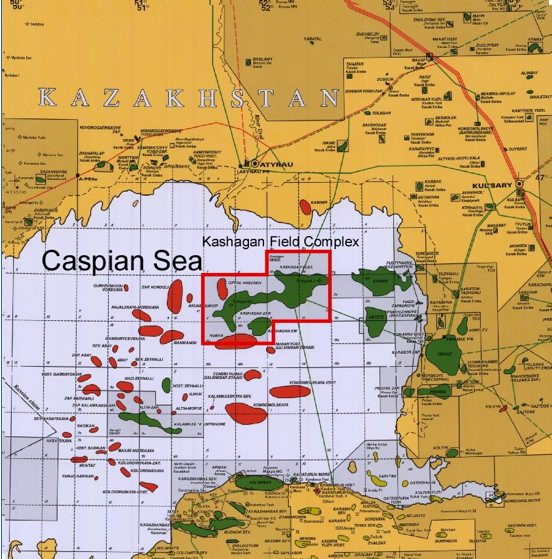

The Kashagan field was discovered in 2000 and represents a large, “lifetime find” of oil reserves. These have been estimated at 750,000 mmboe, or 750,000 million barrels of oil equivalent: ah, 7.5 x (10 to the 11th power) of barrels of oil equivalent. There is often an element of testyria involved in early reserve numbers, more from the political side than the oil company side: engineers looking somewhat askance at the politicians, you understand. And at Kashagan with its multiple extraction problems, the engineers have been right to have that look:

1. In 2001, the CEO of ENI forecast production to begin in 2005. Last month, ENI reported that delays on the field will push back production two more years, to 2010.

2. Last year, Forbes/AFX reported a more recent reserve estimate that put Kashagan reserves at 45 billion barrels, of which 10-13 billion are considered recoverable. That's still a lot: and with that recovery rate, it also implies an irregular geology and hence a lot of technical problems. The initial investment cost for oil extraction was estimated at USD 29 billion, or USD 2.9 x (10 to the 10th power). In 2005, this estimate was revised upward 17%, or USD 4.93 billion more.

By the numbers:

1. Kazakhstan owns all of the oil. Period, zero.

1. Kazakhstan owns all of the oil. Period, zero.

2. A consortium of independent and national oil companies have contracted with the state to bring that oil up in a kind of partnership agreement by shares. Oil companies provide investment and technology in return for a percentage of the oil extracted, which they turn around and sell. This is known as a PSA or profit-sharing agreement. At Kashagan, the percentage going to the companies totalled 90%, with Kazakhstan keeping 10% of the title of extracted oil. They are now negotiating for 40% for the state's share, which means that the consortium would revise its yields downward, but not in its percentage of the PSA. (see numbers below).

The consortium is led by a majority-interest oil company who operates the oil well–hence, that lead company is called the “operator”. At Kashagan, that company is Italy's ENI, which is a subsidiary or majority-owned or whatever of Italy's Agip (AgipKCO). The stockholders in extraction include:

ENI (Italy) 18.52%

ExxonMobil (US) 18.52%

Total (France) 18.52%

Shell (EU) 18.52%

ConocoPhillips (U.S.) 9.26%

KazMunaiGas (Kazakhstan) 8.33%

Inpex (Japan) 8.33%

One should note that Kazakhstan receives 8.33% of the corporate portion of production via KMG, plus all of the state portion of production. By entering the PSA, Kazakhstan (through nationally-owned KMG) increases its own investment in its principal producer of state revenue. It puts money into extraction, gains technical knowledge, and further participation in the project's profit.

Kazakhstan's side:

1. Paying out and paying out again.

This means also that project cost overruns and project delays hit Kazakhstan twice: first, in oil recovery, and second, in investment. All the investment in an oil well is front-loaded: it's on spec. You have to put in billions before you see a dime. That is why oil companies have (and should have) large budgets.

This is also why states, particularly developing states, cannot deal as easily with cost overruns and delays. They have a state to run, with social security payments and farm subsidies and national health programs, and people who are old or indigent or facing crop failure now cannot wait for their state to pay out those funds. You can lay off workers, but you can't lay off citizens. The 2005 cost reassessment meant that KMG and Inpex (8.33%) had to come up with USD 410,669,000–411 million each–while ENI and other major (18.52%) shareholders would have to come up with nearly another billion apiece.

2. Petro-politics and petro-promises:

Furthermore, Kazakhstan has engaged to supply multiple customers, most of them powerful, and some of them contiguous neighbors. Along with recent pipelines to China being built in carefully-crafted stages, Kazakhstan has agreed to ship oil via the BTC pipeline through Azerbaijan, Georgia, and Turkey.

About the time that Azerbaijan's oilfields begin to slow production, Kashagan oil was going to fill the BTC to capacity and extend the life and usefulness of that USD 4 billion project. Oil to the West via BTC was one major guarantor of good Kazakhstan-EU/US relations–not the only one, but a good one.

Not having this oil supply come through hurts Kazakhstan's westward ambitions. And there is also the inevitable punishment that comes from losing utility. The EU/US will not treat Kazakhstan the same without this production coming through, whether it's a no-fault situation or not. It's a matter of who's necessary to whom: the old quid pro quo. It's not fair, of course, but that makes no difference.

3. Externalities:

One undesirable aspect of oil for oil supplier states is that it depresses other kinds of investment in other sectors of the economy. While Kazakhstan does rely mainly upon its oil for revenue, it is working upon building up other income streams, in agriculture, light industry including electronics, and banking. The inflationary pressures on an oil-supplier state remain a challenge to non-oil related domestic enterprise.

Oil spills and other environmental problems reduce fish stocks and other wetlands-based businesses. Many of these are small businesses, employing the vast majority of Kazakhstan's labor force. This year's seal deaths have been treated as a warning about oil depredations in the Caspian. All environmental problems have an adverse effect on the economy and on public health.

Independent oil's side:

That is not to say that the oil companies are thrilled by the production delays, cost overruns, and environmental hazards, because they couldn't be:

1. Honesty hurts

Technical limits are a proof of honesty that nobody likes. The PSA partners can't be happy that only 13 billion barrels out of 45 billion is recoverable, because it cuts into their returns on investment. But it does prove that they are using a good technical understanding: not trying to extract past their technical capability and thereby ruining what is left by using faulty, short-sighted extraction methods.

Furthermore, as an interested outside observer, it looks as if Kashagan has been nothing but unpleasant surprises in succession as soon as it was attempted. The revised downward estimates and many production delays testify to an oil that is probably under very high pressure, which is hard to control, with a difficult terrain, which is hard to extract, and with a technology that has to be developed over and over anew to suit Kashagan's unique situation. Sort of like finding a dream companion, only to discover that that companion has serious issues.

2. Paying out and paying out again:

As oil is extracted through speculative investment, every delay doubles the risk that oil companies face in its international operations. Kazakhstan will demand more based upon its ownership of oil resources and its sovereignty over the territory upon which the Kashagan platform rests. As each PSA partner puts in funds for cost overruns, the investment becomes riskier in amounts spent as well as higher risk that all investment will be lost. Kazakhstan's stated demands of more percentage will affect the profit/loss sheet for all of these companies. For instance, should Kazakhstan retrieve 30% of the extracted oil, percentages of production that are left for the PSA partners goes down, while their share of the expenses stay the same.

Here's the math: If you own 18.52% of the PSA, you were getting 18.52% of 90% of the oil, which comes to 16.65% of the yield.

(.1852 x .9 = .1665).

If you suddenly find yourself getting 18.52% of 60% of the oil, your yield percentage drops to 11.124% of the yield.

(.1852 x .6 = .11124).

For 9.26% of the PSA (Conoco Phillips), your yield drops from 8.325% to 5.562%.

For 8.33% of PSA, (Inpex, KMG), yield drops from 7.5% to about 5%.

In short, the risk goes up, the profit goes down by one-third, and the responsibility remains the same. No guarantees.

3. Industrial politics and industry promises:

Delays at Kashagan also render vulnerable their ties to states and companies doing business in other parts of the Caspian or other parts of Kazakhstan. I have already mentioned the BTC line: Inpex, for instance, is also part of the BTC consortium, and delays at Kashagan adversely affect their investments in BTC as well. In addition, even non-related oil companies in the Caspian have relations with each other that can be strained by Kashagan non-performance and mis-handling.

It's political between companies too: they understand the best, but they are also the most nearly involved. If ENI has made a mull of it (which I don't know), the other oil companies will know this through their own technical knowledge and inter-industry connections. If ENI's non-performance sets a precedent for other contractual negotiations, ENI will have a lot of humble pie to eat. And if ENI loses Kashagan through Kazakhstan's expropriation of assets, all the partners are going to be severely wounded by the lost investment. This latter consequence is the worst-case scenario on which the business press is speculating.

4. Externalities:

Not every oil company is mindful of externalities, and most of them are not mindful out of deep-seated conviction. But international scrutiny and their insurance premiums have made them more attentive to the issues involved. All of them view economic and environmental hazards as a liability to their operations. Most of the time, oil companies are glad to include any procedure that will make their insurance go down, keep their host countries happy, and reduce waste. Big flash: oil companies don't like spills or fires–that is non-recoverable, wasted assets. Unfortunately, this kind of mistake causes big problems for the environment. You don't have the same latitude for failure in the oil business that you do in many others.

Furthermore, in general oil majors operating in Kazakhstan are dealing with some seemingly un resolvable problems. We don't like sulfur in our fuels, for instance; sour gas creates more pollution and is harder to refine. When that sulfur is extracted out, it goes into a world market that is supply-glutted. Many of the environmental violations for oil in Kazakhstan have to do with a sulfur that nobody wants, causes pollution, and that oil companies would be more than happy to get rid of at almost any low price you could name.

So no, that does not answer the allegations of decline in Caspian fish stocks, or the deaths of seals, or the competing rights of the tourist industry to Caspian shores. But it does point the way to a reasonable dialogue, which I expect Kazakhstan will be having over the next three months with oil majors.

Currently:

1. Kashagan is shut down for three months. Some new share arrangement will be coming up. The share arrangement will recognize more of Kazakhstan's risk in the process but will not solve the problem of overall risk to investment.

2. ENI and partners will pay fines for inadequate fire protection regimens, which may have been serious, but are probably symbolic of Kazakhstani sovereignty.

3. They will also pay some environmental fines and may have to come up with a new plan for damage mitigation.

4. Mr. Prodi, the Prime Minister of Italy, will be in Kazakhstan to bolster ENI diplomatically.

4. Mr. Prodi, the Prime Minister of Italy, will be in Kazakhstan to bolster ENI diplomatically.

5. Kazakhstan will appoint a new energy minister to replace Mr. Izmukhambetov.

And in the end:

The oil will come out of the ground, eventually. It's up to ENI and partners to figure out how to make it go through BTC and keep some title.

Photos: offshoretechnology.com; the oil drum; and liberi, Italy.