Public anger over austerity in Greece. Via: Flickr by how will I ever

There seems to be a widespread belief that Greece is in the trouble it is in today because it will not implement the policies that Europe has demanded of it. While it has neglected some reforms, it has adhered to Europe’s key austerity demands more faithfully than any other country in Europe. It appears, however, that this very policy, far from constructing the anticipated sound foundation, has driven the Greek economy into the ground. That is why Greece does not want to follow that path any more.

You could argue, I suppose, that the roots of the Greek crisis go back to the failure of traditional Keynesian economics to explain the “stagflation” of the 1970s. Stagnation and inflation were not supposed to happen at the same time. Thus, many academic economists began to move away from Keynes and his assumptions. Governments, too, were becoming less enthusiastic about Keynesian fiscal policies, in particular, which were rarely nimble enough to deal with the relatively quick fluctuations of the routine business cycle. As a result, there were fewer active efforts to manipulate the economy to avoid recessions and inflation and toward a greater reliance on markets to regulate themselves.

When the Economic and Monetary Union (EMU) was built within the European Union (EU) in the 1990s, it followed this model. As several countries moved toward the use of a single currency (eventually called the euro), a European Central Bank (ECB) was built, but its functions were limited to fighting inflation. No common fiscal institutions were created whatsoever. Instead, member countries retained their own sovereign fiscal institutions and policies. They were instructed to keep their budget deficits within three percent of GDP and national debt within 60 percent of GDP, but these restrictions have been routinely violated by member countries without triggering sanctions.

Germany, the largest economy in the European Union, was particularly fond of the new arrangement (indeed, it had insisted on it), given its own focus on balanced budgets and inflation. Germany had been scarred by the hyperinflation that it suffered in the early 1920s. (In November 1923, a loaf of bread cost 200,000,000,000 marks.) One of its highest priorities was to prevent any of the less disciplined countries of Europe from imposing inflation on it through the new monetary union. That, however, has not prevented Germany from violating its own restrictions on deficit and debt.

Most EU members transitioned to the euro as the common currency from 1999 to 2002. Greece’s acceptance into the EMU was delayed until 2001 because of its unacceptable deficits and inflation rate, and many Europeans were skeptical of its prospects even then. Once the “eurozone” was born, it created the impression that lenders were dealing with a single politico-economic entity, that buying euro-denominated bonds from the Greek treasury was the equivalent of buying euro-denominated bonds from the German treasury. Money began flowing freely out of core European economies into Greece and other peripheral economies.*

In Greece, interest rates fell, inflation grew and relative productivity plummeted. Current accounts were soon out of balance in both core and periphery. The periphery ran large deficits, while the core ran correspondingly large surpluses, as the peripheral economies used the money to buy things from the core economies. The core economies were, in effect, growing at the expense of the weaker peripheral economies, which financed their deficits by borrowing even more from German, French, and other European banks.

Then, in 2010, the euro crisis hit, the Greek bubble burst and demand collapsed. The unemployment rate in Greece peaked at 28 percent, and has been holding steady at 25 percent. Youth unemployment approaches 50 percent.

Despite the appearance of a single European politico-economic system, when the crisis hit, Greece was not able to rely on overall European fiscal resources, but on its own meager capacity, immediately generating a fiscal crisis at the national level. When the Germans and other members of the European core looked at Greece, they saw the profligate and sometimes fraudulent borrowing accompanied by corruption, widespread tax evasion, an unaffordable pension system and other fiscal problems.** These problems were real and needed to be addressed, although arguably the middle of an economic crisis was not the best time for some of them. Yet the leaders of the core economies failed to recognize their own contribution to the problem, or even raise the issue of addressing their own current-account surpluses, which continued to siphon money out of Greece.

Because Greece was a member of the EMU, certain policy options available to other countries in crisis were not available to it. For instance, it could not improve its current-account balance by devaluing its currency relative to its major trade partners because they were using the same currency. (As a consequence of the single currency, German companies that export outside the eurozone benefit every time the Greek crisis drives the value of the euro lower.) Greece could not expand its money supply in an effort to lower interest rates and boost domestic demand because it had no control over monetary policy. Monetary policy was decided at the continental level, primarily in ways consistent with Germany’s preferences, which are the opposite of Greece’s needs.

While Greece’s fiscal problems required reducing its budget deficits, a logical accompaniment to that would have been for Germany to expand its own economy and buy more things from Greece. That would have given a boost to demand in the Greek economy and helped reduce the imbalance in their mutual current accounts. Instead, European leaders offered Greece a bailout consisting of even more loans, the proceeds of which were dedicated not to easing a Greek fiscal transition but almost entirely to paying back European banks for older loans. In return for this, Greece was expected to eliminate its budget deficits through austerity — by increasing taxes and reducing government spending and pensions, laying off workers and privatizing state-owned assets.

The austerity approach has proved to be counterproductive. That may not be true in every situation, but it is true in the conditions prevailing since the global economic crisis of 2008, a situation in which consumer demand and corporate investment collapsed and interest rates are stuck near zero. The problem of insufficient demand cannot be remedied by depressing demand even further, which is the consequence of reducing government spending. Even if other reforms were to succeed in improving productivity, companies will have no reason to take advantage of that productivity if there are no consumers. The IMF’s own research department, after studying the impact of Europe’s austerity policies in the aftermath of 2008, concluded that for every $1.00 cut from government spending, economic activity was reduced by roughly $1.30. Thus, austerity has depressed economies even further, and no country in has pursued austerity more than Greece.

The Greek bailout of 2010 had to be followed by another in 2012. That one involved writing off 75 percent of Greece’s debts and the transfer of most of the remaining debt from private banks to public European institutions (shielding the core economy banks in the event of a Greek default). It appears that yet another bailout is required now.

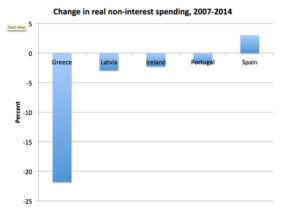

From 2007 to 2014, Greece reduced government spending by more than 20 percent, far more than any other country in the EU, including countries held up to Greece as models. In the same period, Greek GDP has contracted by 20 percent, and per capita consumption by even more. (Keep in mind that 20 percent of GDP is much more than 20 percent of the budget, even in Greece.) Greece’s debt burden (that is, its debt-to-GDP ratio) has worsened under the recovery plan not only because of the additional loans but because its GDP is smaller. Whereas the Troika supervising Greece’s economic recovery program (the European Commission, the ECB and the IMF) predicted in 2010 that their program would turn the Greek economy around in 2011 and have it approaching precrisis levels by now, the Greek GDP still remains 20 percent below that figure. While Greece showed signs of growth in 2014 (0.8 percent) for the first time since 2007, it slipped back into recession in 2015.

Greece’s deficit reduction (first bar) has been substantially greater than any other European country’s. (Graph: European Commission, via Paul Krugman’s blog, Conscience of a Liberal, www.nytimes.com)

The Syriza government that came into office in Athens in January sought to renegotiate the terms of Greece’s recovery program. The latest offer from the Troika, which officially expired on June 30, would have required Greece to increase austerity further, raising the country’s primary budget surplus (i.e., revenues minus expenditures excluding interest payments on outstanding debt) in stages from 1 percent of GDP this year to 3.5 percent of GDP starting in 2018. Although Greece did achieve a primary budget surplus in 2014, it is back in deficit in 2015.

All this comes at the same time that the IMF is acknowledging that Greece will never be able to pay its debts in full even if it follows the Troika’s demands to the letter. Some observers see this as a European conspiracy to keep Greece down, yet that does not seem right either. European leaders appear to believe in the healing effects of austerity; the entire continent has followed the austerity path, albeit not as extremely as Greece. They do not want to bend the rules for Greece in large part because they fear that other countries will then demand to be released from the general austerity prescription. Yet, according to some economists, austerity is the reason that the entire European continent is barely keeping its collective economic nose above water — and has repeatedly threatened to drive the global economy back into recession — regardless of the repeated proclamations of success coming out of Brussels. In 2009, unemployment was 9.5 percent in both the United States and the eurozone; in 2015, unemployment is 5.4 percent in the United States and 11.1 percent in the eurozone.***

Now, of course, the United States also has states with different economic trends and different levels of development, just like Europe, but because the United States considers itself a single country, it handles fiscal issues differently. Florida did not have to deal with its real estate crisis on its own in 2008; if it had, it would have suffered bankruptcy as well. Federal funds flow freely from state to state. The Federal Reserve Bank of San Francisco has calculated that Mississippi, for example, receives $500 per capita more in federal transfers than it pays in federal taxes, whereas Delaware pays $13,000 per capita more in federal taxes then it receives in federal transfers. This goes on perpetually. Since we all live in the same country, however, we do not see it as a crisis, do not call it a bailout, do not demand that Mississippi pay the money back, and do not exact punishment for the state’s failure to cover its own expenses. It is simply government functioning.

Since 2010 the ongoing euro crisis has prompted the EU to strengthen some of its economic and financial institutions. Still, Jean Monnet’s dream of a United States of Europe clearly is still a long way off.

*In the case of Greece, the government borrowed large amounts. In Spain and Ireland, large amounts flowed into the private sector, fueling large real estate bubbles. When the crisis hit, both of those countries suffered despite the fact that their government budgets were actually in surplus at the time. Greece is really the only country where government debt played a substantial role in the crisis, which suggests at least the possibility that the Greek crisis could have happened even if the government had not borrowed so much.

**The Greek pension system manages to be a significant fiscal burden (about 18% of GDP, half of which comes out of the national budget) without being especially generous on an individual level. For nearly half the recipients it is below the poverty line, and for many households (especially these days) it is the only source of income. Unfortunately, this makes it extremely difficult to forge a compromise.

***The United States has probably focused too much on deficit reduction, slowing its own recovery, but not as much as Europe.