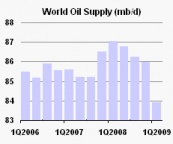

The world is swimming in oil. This coming less than one year after record high oil prices and when the world was running very low in spare capacity (the difference between what can be produced and the amount demanded and the linchpin to lower prices). US inventories are at record levels. Tankers are sitting off the coast of England, waiting for the price to rise so they can get more for their cargo. Companies are holding off on investments because of limited cash and the difficulty for borrowing in current tight credit markets. And this past week the International Energy Agency (IEA) released its April Oil Market Report which predicted that consumption this year will remain at depressed levels (83.4 million barrels per day) not seen since 2004. In addition, the IEA’s head oil analyst David Fyfe commented that

any green shoots are signaling recovery developing next year rather than this year

However, investors are looking for signs, any signs of economic growth . Short-term oil prices appear positively correlated with equities. Oil prices have jumped recently with gains in equity markets on the assumption that stock market gains indicate that economic activity is set to resume, increasing demand for oil. But few, including the IEA, predict prices will rise drastically this year due to depressed economic activity, but volatility will likely remain.

However, investors are looking for signs, any signs of economic growth . Short-term oil prices appear positively correlated with equities. Oil prices have jumped recently with gains in equity markets on the assumption that stock market gains indicate that economic activity is set to resume, increasing demand for oil. But few, including the IEA, predict prices will rise drastically this year due to depressed economic activity, but volatility will likely remain.