China-based solar producer Suntech Power announced plans this week to build a manufacturing facility in the United States to serve the growing U.S. market for large-scale utility projects and to take advantage of government incentives.

“We believe in the outstanding long-term prospects of the solar energy market in the United States” Suntech Chairman and CEO Zhengrong Shi said.

The Suntech announcement reflects the value of federal and state incentives for renewable energy. It also counters a favorite argument of climate action opponents on Capitol Hill that shifting the United States to a clean energy future will send U.S. jobs overseas.![]() Suntech, the world’s largest solar energy company in terms of photovoltaic module production, said it could cut transport costs and emissions by building closer to its market. The cost of shipping heavy renewable units, combined with the fact that the U.S. and EU currently constitute the majority of clean tech demand, makes local manufacturing facilities a sensible strategy for long-term growth.

Suntech, the world’s largest solar energy company in terms of photovoltaic module production, said it could cut transport costs and emissions by building closer to its market. The cost of shipping heavy renewable units, combined with the fact that the U.S. and EU currently constitute the majority of clean tech demand, makes local manufacturing facilities a sensible strategy for long-term growth.

Political considerations were also not lost on the company. Appealing to both green jobs enthusiasts and those who perceive China as taking manufacturing jobs from the U.S, Shi said he is hopeful that “initiating manufacturing in the U.S. will drive further growth of green jobs.”

Suntech America President Roger Efird said as many as 1,000 jobs could be created through Suntech’s U.S. operations over the next few years. The company plans to settle on a location in the next six months.

“We are currently in discussion with the governors of three different states who have been recruiting us to build factories,” Efird has said.

In making the announcement this week, the company specifically identified that its decision would be based on “local manufacturing incentives” and “long-term policy commitments.”

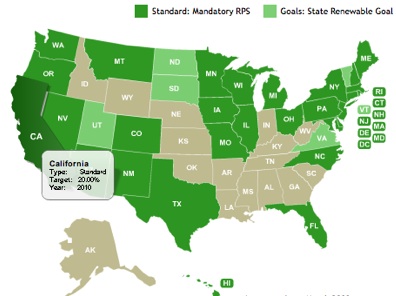

National-level renewable electricity legislation is currently being considered in Congress, and 28 states have their own renewable portfolio standards in place that require utilities to generate a certain percentage of electricity from renewable sources.

In addition, the stimulus bill signed earlier this year provides federal level loan guarantees, grants, and a 30% renewable-investment tax credit to expand the development of renewables, plus state level incentive programs are being formulated to include more extensive measures – including tax holidays, loans and grants – aimed at attracting top companies. Some states, like California and Colorado, have committed to solar-specific subsidies for PV manufacturers.

Texas is considering solar financing legislation that would allocate $500 million for solar incentives. While residential and commercial users would be able to take advantage of rebates – in some cases more generous than those being offered under the California Solar Initiative – 70% of the dedicated funding would be earmarked for utility-scale applications. Franchise tax exemption for manufacturers, sellers, or installers of solar energy devices would put Texas-based companies capable of utility-scale applications at a distinct advantage.

Suntech is one of three major PV manufacturers worldwide that can handle utility-scale applications.

In addition to homing in on increasing state-level solar incentives, Suntech may also be reacting to Chinese government initiatives and guidance.

Late last month, Director Deputy-General Liu Hongkuang of China’s main economic and social policy making apparatus, the National Development and Reform Commission, made a speech before a conference of government officials and state-owned enterprises encouraging China’s energy industry to broaden overseas activities.

While Liu did not specifically single out the solar sector, he explicitly called on energy players to invest in manufacturing ventures overseas, strengthen resource cooperation, and invest in foreign energy infrastructure projects, according to a report by China Securities Journal.

The tone of his comments demonstrate a push to diversify China’s overseas energy activities away from primarily resource investing, in Africa and Australia for example, and towards more technologically advanced investment.

Just how much pressure from Beijing is behind Suntech’s overseas expansion, signaling coordination between central-level energy policy and China’s private industry, is unclear.

Chris Brown, a China Energy consultant with Guymard Consulting who has worked on solar initiatives in the southwestern U.S., believes

“there is likely some NDRC guidance” involved in Suntech’s decision, which is “part of a larger Beijing policy of making China a world renewable energy leader.”

While Suntech has emerged as something of a national champion in China in recent years, its status as a publicly owned, NYSE-listed company suggests it answers to shareholders before it does to Beijing.

The fact that Shi, a naturalized Australian citizen, has had his eye on building U.S. operations for almost three years is further evidence that Suntech is more of a corporation with global aspirations than a government-coddled or -coerced entity.

In November 2007, Shi publicly expressed plans to expand overseas. Steven Chan, chief strategy officer of Suntech, also mentioned building a U.S. plant in late 2008, saying “We see the US market as on the cusp of enormous growth.”

We may never know whether the solar giant’s decision is motivated by new U.S. federal and local incentives; Beijing pressure on the energy sector to invest overseas; a desire to deflect media inferences and advocacy group campaign arguments that China’s clean tech sector is outstripping her American competitors; or some mix of these factors.

We do know the uniqueness of Suntech’s move. As Rhone Resch, president of the Solar Energy Industries Association, notes:

“A Chinese company opening up a manufacturing facility in the U.S. … [is] quite a reversal from what we have seen in the last couple of years.”