I’m baaaack…!! No sooner had I returned from long-overdue mid-Winter get-away for a little rest and relaxation in warmer climes, where I swore off all news & politics for the duration, than I came across this glaring little development which I thought merited coverage…

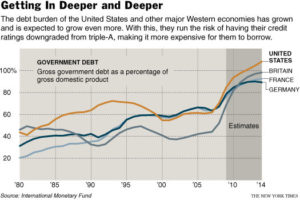

In a warning shot across the bow of the U.S. ‘ship of state,’ Moody’s Investor Services, one of the world’s leading sovereign credit rating agencies, indicated their concern and negative outlook about the fiscal affairs of the nation – as well as some of the other leading Western nations such as the U.K. – and our ability to maintain a ‘AAA’ or ‘triple-A’ credit rating, considered the gold standard of secure credit in international capital markets. Among other things, a triple-A rating generally allows the nation to borrow (by issuing debt) on the most favorable terms and at the lowest cost of capital. Under the ratings company’s so-called baseline scenario, the U.S. will spend more on debt service to investors (e.g., interest payments to creditors such as China) as a percentage of gross Federal revenues (e.g., tax receipts) this year than any other top-rated country except the U.K., and we will be the biggest spender from 2011 to 2013 Moody’s said in its report.

Pierre Cailleteau, managing director of sovereign risk, and one of the reports authors, at Moody’s in London, said “We expect the situation to further deteriorate in terms of the key ratings metrics before they start stabilizing.” The governments of the two economies must balance bringing down their debt burdens without damaging growth by removing fiscal stimulus too quickly. “This story is not going to stop at the end of the year. There is inertia in the deterioration of credit metrics” for both the U.S and the U.K., he added.

Pierre Cailleteau, managing director of sovereign risk, and one of the reports authors, at Moody’s in London, said “We expect the situation to further deteriorate in terms of the key ratings metrics before they start stabilizing.” The governments of the two economies must balance bringing down their debt burdens without damaging growth by removing fiscal stimulus too quickly. “This story is not going to stop at the end of the year. There is inertia in the deterioration of credit metrics” for both the U.S and the U.K., he added.

The U.S. government will spend about 7% of its Federal revenues making interest payments on its debt in 2010; and almost 11% in 2013, according to the baseline scenario of moderate economic recovery, and fiscal adjustments in line with government projections, and an assumption of a gradual increase in interest rates by the Federal Reserve, according to Moody’s. Under its adverse scenario, which assumes 0.5% lower growth each year, less fiscal adjustment and a stronger interest-rate shock, the U.S. will pay approximately 15% of total revenues in interest payments, more than the existing 14% top-limit that would ordinarily lead to a downgrade to ‘AA’ or ‘double-A’ credit status, Moody’s said.

Read more here, and here. Read Moody’s report, here.

In addition, knowing that the ‘Wingnuts’ and the more irrational among us might seize this development and seek to lay blame at the feet of the Obama Administration, it should be noted that approximately 80% of total interest payments are for interest payments on debt issued to pay for the ongoing wars in Iraq and Afghanistan, military cap-ex, and our global intelligence apparati – all areas that they and Republican allies in Washington have been hawkish on for many, many decades, and for which we are still servicing the debt. Moreover, to put things in perspective, it took over 200 years of the nation’s history for the national debt to reach $5 Trn – the level when George Bush took office; by the time Bush left office eight years later, the national debt had doubled to $10 Trn. It now stands at $12 Trn, due almost entirely to funding for the Wall Street bailout, the Federal Stimulus plan to help the economy revive, and ongoing funding for military spending in Iraq and Afghanistan. Further, we spend over $600 Bn per year on military operating costs; and over $1.3 Trn per year, all in, on defense related expenditures — fully 42% of the annual Federal budget! The so-called “trillion-dollar” Healthcare reform plan, on-the-other-hand, if enacted as expected this week will extend basic healthcare coverage to 32 million Americans, pays for itself over ten years, and will reduce the Federal deficit by $138 Bn, according to the most recent CBO estimates. Oh! And BTW, we’re still waiting to see the Republican alternative healthcare plan. . .