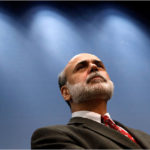

Federal Reserve Chairman Ben Bernanke told Congress on Wednesday that the outlook for the economy remains “unusually uncertain” but that the Fed plans no specific steps “in the near term” to try to fuel the struggling recovery. His comments to the Senate Banking Committee sent stocks tumbling. The Dow Jones industrial average had been up 20 points before he spoke. It fell as much as 160 points during his testimony, but recovered some losses to close down 109 points. Investors shifted money into the safety of Treasury bonds, while the yield on 10-year Treasury notes fell to 2.86%. The Fed Chairman also down-played the odds that the economy would slide back into a “double-dip” recession. But he acknowledged the economy is fragile. Bernanke said the Fed would continue to monitor the strength of the recovery and consider more aggressive action if economic conditions worsened. “If the recovery seems to be faltering, we have to at least review our options,” Bernanke told lawmakers. But he said no further action is planned for now because the economy is still growing. Record low interest rates are still needed to bolster the economy, Bernanke said. He repeated a pledge to keep rates low for an “extended period.”

Meanwhile today, the primary gauge of future economic activity dropped in June, the second decline in the last 3 months, suggesting the economic recovery is weakening. More specifically, the Conference Board, the highly regarded economic research group, said its index of leading economic indicators fell 0.2% in June. Economists polled earlier by Thomson Reuters had expected a much larger drop of 0.3%. The gauge – which measures 11 of the leading performance measures of the nation’s economy –had risen almost every month since April 2009 as the economy rebounded from recession. It was pulled higher by the increasing amount of money in the economy, the rebound in manufacturing and slow, but positive improvements in the jobs market.

Meanwhile today, the primary gauge of future economic activity dropped in June, the second decline in the last 3 months, suggesting the economic recovery is weakening. More specifically, the Conference Board, the highly regarded economic research group, said its index of leading economic indicators fell 0.2% in June. Economists polled earlier by Thomson Reuters had expected a much larger drop of 0.3%. The gauge – which measures 11 of the leading performance measures of the nation’s economy –had risen almost every month since April 2009 as the economy rebounded from recession. It was pulled higher by the increasing amount of money in the economy, the rebound in manufacturing and slow, but positive improvements in the jobs market.

The indicators point to slower growth through the fall, manufacturing rebound will likely slow, and there is little indication of a pickup in the service sector, which employs about 80% of the U.S. work force. – The Conference Board

On the other hand, weakness in the housing sector, faltering consumer spending and high unemployment have raised fears about a possible slowdown in economic growth. “The indicators point to slower growth through the fall,” said Conference Board economist Ken Goldstein. He said the manufacturing rebound will likely slow and there is “little indication” of a pickup in the service sector, which employs about 80% of the U.S. work force.

Five of the 10 indicators increased, while 4 declined and an estimate of manufacturers’ new orders for capital goods was flat. On the employment data — fewer hours worked in factories and more people filing for jobless aid — weighed down the index, as did declining stock market performance.

The biggest positive contributions were the money supply, which increased, and the difference between the benchmark 10-year interest rates and the overnight interest rate that the Federal Reserve has kept at a record low near zero. A wider gap between the two can mean investors expect economic activity to pick up. Still, that gap continues to narrow as investors looking for safe harbors from the tumultuous stock market bought heavily in medium-term Treasury notes and other fixed income products, which results in weighing down bond yields as demand grows.

My big issue is whether there will be a slowdown in the second half of the year and on the basis of what we are hearing from the U.S. economy and signs of a cooling off in China, I think it is very likely we will see a slowdown.

– Ken Wattret of BNP Paribas, France

Although, the U.S. economy resumed growth about a year ago, stubbornly high unemployment and recent weak economic data have raised concerns about a more significant slowdown – not only domestically, but it could also impact our European allies.

The Euro zone’s manufacturing sector, which over the last 12 months has driven a large part of the economy’s return to growth has also accelerated, according to the latest data. Economic measures also showed consumer confidence in the Euro zone climbed to a two-year high in July. The concern now among European economists is the threat that the sluggish nature of the U.S. economy, as well as a slower, but still robust, economy in China may pose a risk to further growth in Europe. “My big issue is whether there will be a slowdown in the second half of the year and on the basis of what we are hearing from the U.S. economy and signs of a cooling off in China, I think it is very likely we will see a slowdown,” Ken Wattret of BNP Paribas, said in a Reuters interview after the release of Thursday’s European data.

Also in the United States, a report from the National Association of Realtors showed home sales fell 5.1% to an annual rate of 5.37 million units. Another economic report earlier this week showed new U.S. home construction in June hit its lowest levels in eight months. Get set, economically, for a bumpy ride through the end of this year!

Sources: The Conference Board, RGE Monitor, AP Photo: NY Daily News