9 Nov 2010 UPDATE: Interestingly, in today’s Wall Street Journal, in a front page article, Germany, Russia, China and other global financial centers joined in the nearly global backlash against the Federal Reserve Bank’s competitive devluation strategy. And while abroad, President Obama defends the policy as a ‘pro-growth,’ and job creation strategy for the US economy.

(NYTs) HONG KONG — A rising chorus of central bank policymakers in emerging market nations criticized the Federal Reserve on Thursday for its decision to pump more money into the U.S. economy – a monetary policy known as competitive devaluation, or Quantitative Easing – a measure that they fear could escalate the worrisome influx of cash into fast-growing economies around the world. Economists and officials from Brazil to South Korea condemned the move and threatened more measures to curb the flood of money that has pushed up currency values and fueled concerns that asset price bubbles might be in the making in their countries. The unusually sharp backlash against the Fed’s action underscores the divide among some of the largest economies in the world over appropriate economic policy and is likely to overshadow a gathering of leaders of the G-20 world’s leading economies in Seoul, South Korea next week. (Look for full coverage of the G-20 here next week!)

The Brazilian foreign trade secretary, Welber Barral, said that the Fed’s policies would impoverish “those around them and end up prompting retaliatory measures,” according to Reuters. In South Korea, the Finance Ministry said it would consider ways to limit capital flows. While some inflows, particularly long-term investments, are welcome ways of bolstering economic development, the capital influxes into emerging market stocks, bonds and property have increased rapidly in recent months, totaling more than $2 billion a day, according to estimates by DBS in Singapore.

Some countries have also already announced or signaled steps to discourage capital inflows. Brazil and Thailand, for example, last month raised taxes on foreign investment in government bonds, a step designed to deter excessive inflows. Capital controls have so far not been “too Draconian,” said Yougesh Khatri, senior Southeast Asia economist at Nomura, in a conference call from Singapore on Thursday. But the risk is that such measures might escalate in the longer term, he added, while more foreign exchange intervention is likely. The reaction by Asian stock markets to the Fed’s announcement was relatively muted, as investors had long anticipated a major purchasing program. The Hang Seng index in Hong Kong rose 1.6 percent Thursday, while the Nikkei 225 index in Japan played catch-up after a public holiday, gaining 2.2 percent. The Kospi in South Korea edged up 0.3 percent, while the Straits Times index in Singapore was up 0.5 percent late today.

Some countries have also already announced or signaled steps to discourage capital inflows. Brazil and Thailand, for example, last month raised taxes on foreign investment in government bonds, a step designed to deter excessive inflows. Capital controls have so far not been “too Draconian,” said Yougesh Khatri, senior Southeast Asia economist at Nomura, in a conference call from Singapore on Thursday. But the risk is that such measures might escalate in the longer term, he added, while more foreign exchange intervention is likely. The reaction by Asian stock markets to the Fed’s announcement was relatively muted, as investors had long anticipated a major purchasing program. The Hang Seng index in Hong Kong rose 1.6 percent Thursday, while the Nikkei 225 index in Japan played catch-up after a public holiday, gaining 2.2 percent. The Kospi in South Korea edged up 0.3 percent, while the Straits Times index in Singapore was up 0.5 percent late today.

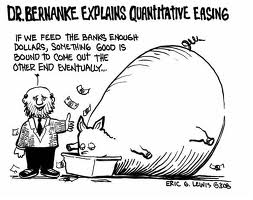

Analysts and policy makers are concerned that the Fed’s injection of more liquidity into the U.S. economy — through purchases of Treasury securities to the tune of $600 billion — could lead to yet more inflows as investors seek higher returns. “As long as the world exercises no restraint in issuing global currencies such as the dollar — and this is not easy — then the occurrence of another crisis is inevitable, as quite a few wise Westerners lament,” Xia Bin, an adviser to the central bank of China, wrote in a newspaper managed by the People’s Bank of China.

While the United States argues that China in particular should allow its currency to appreciate more rapidly, China and other emerging markets are loath to do so. They argue that the additional round of quantitative easing by the Fed is in effect helping to depress the value of the dollar artificially while… Read more here.

Sources: NYTs, Daily Bail blog, Google images.