Hat Tip to Vincent Wade…

Lately, there has been much attention paid to China’s growing control over precious finite resources, with the focus being on China’s punitive export embargo on “rare earth” minerals against Japan as outlined here:

Without naming China, 37 leading companies and business groups from the U.S., the European Union, Japan, South Korea, India and Brazil sent an open letter to the recent G20 summit in Seoul expressing alarm at rare earth restrictions and calling for an end to government “interference with commercial sale of rare earth elements, domestically or internationally, to advance industrial policy or political objectives.”

Although China has denied imposing an embargo, Japanese officials and rare earth industry sources say that all Chinese shipments of the minerals to Japan had been blocked since Sept. 21, when the long-standing East China Sea dispute flared anew. Following the expressions of concern from Japan and other leading economies, Japan’s Trade Minister Akihiro Okato said Nov. 13 on the sidelines of the APEC summit meeting in Yokohama that he had been assured by a senior Chinese official that rare earth exports to Japan would be accelerated.

Some shipments to the U.S. and Europe were also halted in mid-October, after the U.S. said it was bound to support its Japanese ally in any military crisis over the Senkakus.

In late October, most rare earth exports to China resumed to the U.S. and Europe, but not to Japan. If this was an attempt to divide Japan from the West, it has not worked. Prices for some rare earths have risen as much as nine times this year, as China cut export quotas and then imposed the overseas shipment bans, affecting all foreign consumers and increasing the likelihood of shortages.

China has recently resumed shipments to Japan, but in previous months there has also been grumbling in the West over China’s supposed aggressive increase in foreign direct investment in Sub-Sahara Africa. The concern is mostly related to investment in the primary raw materials China needs to keep its economic engine running.

An issue concerning China and natural resources that has not gained much media attention, despite being highlighted in a Pentagon report published last February, is petroleum acquisition competition. The JOE (Joint Operating Environment) report delved into the controversial topic of Peak Oil Theory. A theory which some still consider a crackpot dystopian delusion, although the Pentagon is now taking it seriously, or at least a version of it.

The JOE, published by the U.S. Joint Forces Command (USJFCOM), is a 5 year forecast of global trends that will potentially affect military operations. The report focused specifically on potential competition over limited remaining oil resources with China, which could easily escalate to military conflict.

The Peak Oil theory was first proposed by Shell Oil geologist M. King Hubbert in 1956. He believed the total amount of recoverable world oil is finite. Further, once peak production had passed, the remaining oil would grow increasingly more costly as it became more scarce. Since Hubbert, many Peak Oil theorist have been greeted with disdain from the Energy industry establishment. However, a new generation of theory promoters can count senior Western oil-company executives and current and former officials of the major world exporting countries among their ranks. Many may not believe that half the oil in the world is nearly exhausted, but they all seem to believe that a global production ceiling is inevitable, and most importantly, upon us. There are many reasons for this, including restricted access to oil fields, spiraling costs, and increasingly complex oil-field geology. This will create a global production plateau, which is technically not a peak. still, the end result is production that cannot possibly meet growing demand. Which is the basis for the JOE’s conclusion:

“The potential of future energy supplies nearly all present their own difficulties and vulnerabilities. None of these provide much reason for optimism,” the JOE states.

The report goes further, stating that it is possible for surplus oil supplies to peak as early as 2012. By 2015 there will be a 10 million barrel per day shortfall!

Besides higher prices, the Pentagon sees the possibility that the situation will be made worse if a cartel of hostile energy producing states collude in set market prices. NO surprise who the usual suspects are: China, Russia, Iran, and Venezuela.

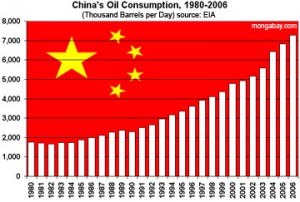

Paying special attention to the situation with China, which has been witnessing breakneck increases in demand for oil to keep its economy growing, Beijing might become America’s largest single global competitor for very limited oil resources, especially if it’s economy took a serious long term hit:

“A depression in China would mean a depression worldwide. The Department of Defense worries about that, too. “One should not forget that the Great Depression spawned a number of totalitarian regimes that sought economic prosperity for their nations by ruthless conquest,” the JOE report warns.”

There are varying predictions floating about, all fairly dire. Industry experts have estimated that by 2050, the per capita energy consumption of China and India would likely approach that of South Korea, which does not sound like a lot, but if the Chinese and Indian populations grow at commonly projected rates, combined, they would consume more oil than the entire world used in 2007.

Many industry insiders agree that Peak Oil is a reality:

In January of 2008, Jeroen van der Veer, chief executive officer of Royal Dutch/Shell, e-mailed his staff that the world will peak in conventional oil and gas within the decade.

John Hess, chairman of Hess Corp., a global oil and mineral exploration company, has stated that, “An oil crisis is coming in the next 10 years. It’s not a matter of demand. It’s not a matter of supplies. It’s both.”

Christophe de Margerie, CEO of French oil company Total S.A., has said that production of even 100 million barrels a day by 2030 will be “difficult.”

James Mulva, CEO of Conoco Phillips, the third biggest U.S. oil company, told a Wall Street conference: “I don’t think we are going to see the supply going over 100 million barrels a day … Where is all that going to come from?”

A major, done by the Bush Department of Energy in 2005 noted:

“The world has never faced a problem like this. Without massive mitigation more than a decade before the fact, the problem will be pervasive and will not be temporary. Previous energy transitions (wood to coal and coal to oil) were gradual and evolutionary; oil peaking will be abrupt and revolutionary.”

This year, a three-volume, 700-plus-page report from the IEA came to the conclusion that, the “age of cheap oil” has come to an end. IEA projections show that by 2035, the demand for oil will increase from about 84 million [xls] to 107 million barrels per day, and prices will rise and stay around $135 per barrel, which is over a 65% increase from today’s price.

The real issue is not really lagging production, but increasing demand, and legacy technology. The availability of technologies that use alternative form of energy or make oil use more efficient is the solution. Sounds simple enough, but that technology does not yet exist, or at least not in a way that it can be practically applied. It is wishful thinking to assume that it will exist in time to prevent a global crisis, but time will tell.

Soon, this blog will take a look at potential areas of conflict between China and neighbor states over the most precious of resources, water.