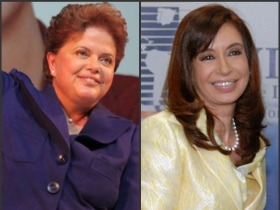

Dilma and Cristina: Madam Presidents Rousseff of Brazil and Fernandez de Kirchner of Argentina at the G-20 Summit. Source: http://imgs.sidneyrezende.com

Latin America appeared in force at the G-20 Summit in Seoul. Two of the three Latin American presidents there were women, Presidents Dilma Rousseff of Brazil and Cristina Fernandez de Kirchner of Argentina, who likewise represented half of the female leaders at the G-20. Unprecedented.

Latin interests in the G-20 are diverse, given Argentina’s heavy reliance on commodity exports, Mexico’s integration in North American manufacturing, and the scale and scope of the Brazilian economy (producing diverse manufactures and commodities for export and domestic consumption). Yet clearly, the region as a whole should be enlisted in efforts, exerted notably by President Obama, to pressure China to abandon its currency peg. Brazilian leaders have lamented the loss of competitiveness of the real, which floats with an ample degree of freedom. Sure, Brazil and Argentina benefit from China’s bottomless demand for commodities, from foodstuffs to metals and energy. Nevertheless, the competitiveness of Latin manufacturing suffers. Moreover, for Mexico, China’s rise has been almost entirely a loss, though the support the Dragon has given to energy prices has helped moderate fiscal pressures south of the Rio Grande.

America’s loose monetary policy – featuring quantitative easing – was attacked at the Summit as a cause of financial speculation in emerging markets, including in Latin America. Latin countries have taken measures to control capital inflows and have joined the chorus opposing US monetary policy. On the other hand, this monetary policy is the right one for the US economy, which remains a key locomotive of global growth. Leaders of emerging economies, including in Latin America, should be careful what they wish for.