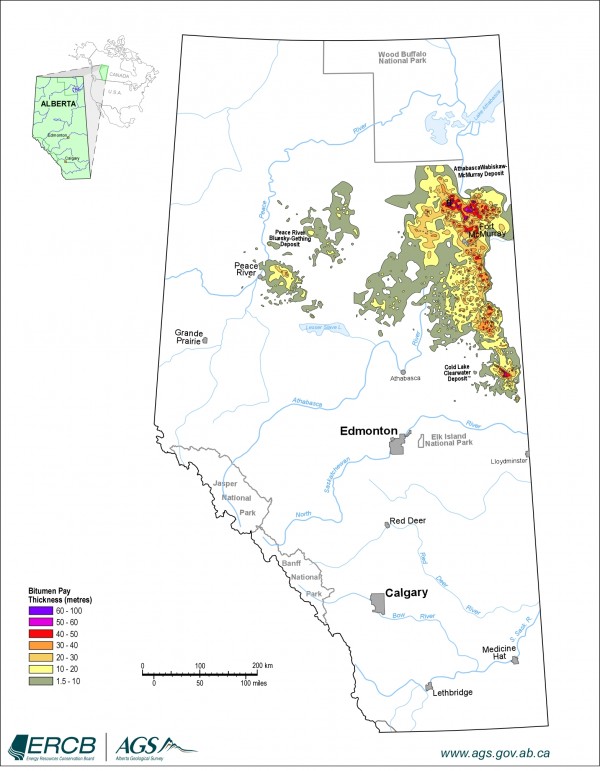

Alberta (Canada) Oil Sands Map

Source: http://www.ags.gov.ab.ca/energy/oilsands/index.html ; Alberta Geological Survey

I spent the last week on a tour of the Canadian oil sands in Alberta talking to oil sands industry representatives, Government of Alberta officials – the regulator – and environmental think tanks. I am now back in New York with interesting insights, a far better understanding of “everything oil sands” and many thoughts I would like to share with readers on oil sands development in Canada and by extension opportunities for the U.S.. This is a major topic both in Canada and the U.S. given the proposed Keystone XL pipeline project which would link this relatively young and growing oil industry to the thirstiest energy market in the neighborhood. That pipeline would stretch from Canada through the U.S. Midwest in order to transport crude oil from Alberta to refineries on the U.S. Gulf Coast. It is crucial to remember that those Gulf refineries had been built to process extra-heavy oil from foreign sources such as Venezuela and Mexico. As for the former a U.S. Geological Survey from October 2009 estimated a range of “380 to 652 billion barrels of technically recoverable heavy oil in the Orinoco Oil Belt Assessment Unit of the East Venezuela Basin Province” – thus containing one of the world’s largest recoverable oil accumulations in our neighborhood. However, oil production is in a steady decline due to a lack of proper foreign investment into the country’s oil industry and infrastructure because of the political risk surrounding President Hugo Chavez’s reign as well as his grip on Venezuela’s state oil company PDVSA that not only remains highly politicized but is also – even worse – used as an ATM for any federal budget shortfall. Now, why is this important?

In contrast, Alberta’s comparable oil would come from a politically stable and democratic neighbor and would be sent to the U.S. via pipeline – a relatively safe and secure method of transportation. This is actually what we should envision when we talk about energy independence. Any increased supply in the future could further reduce U.S. dependence on foreign-sourced oil from Saudi Arabia, Nigeria, or Venezuela. Robert Rapier uses EIA data in his article for csmonitor.com to show the top 15 sources of foreign oil coming into the U.S. in 2011. The top exporter to the U.S. is Canada, followed distantly by Mexico, Saudi Arabia, Nigeria, and Venezuela. As for Venezuela, the chart – showing clearly deteriorating oil output and therefore over time slowing exports to the U.S. from 2001 to 2011 – only underlines what I have elaborated on above. Moreover, except for Canada all other countries I have just mentioned are abundant with political risk – the critically important oil revenues helping to keep a lid on all kinds of boiling societal tensions – and are not known to be beacons of democracy and/or political stability in often very volatile regions.

This is something to think about before the not sufficiently informed starts “demonizing” Canadian oil sands production. The Consumer Energy Report quotes someone from the Natural Resources Defense Council, a lobbyist group for ecological awareness in natural resource development, by saying: “The broader climate movement is absolutely looking at this administration’s Keystone XL decision as a really significant decision to signal that dirty fuels are not acceptable in the U.S.” In this regard, please allow me to let the graphic chart below speak for itself while only pointing out that applying double standards in respect to the graciously awarded label “dirty fuel” is not helpful in reducing CO2 emissions from oil sands production given that the Canadian regulators and the oil sands industry are actually both committed to work together and reduce those emissions.

The term “unconventional” in connection with oil sands refers to the fact that the crude oil is produced in a more cumbersome and less efficient way and therefore requires more energy than extracting conventional oil from the ground e.g. in the desert of Saudi Arabia. According to researchers at eco-innovative CanmetENERGY we can distinguish three main classes of ore based on bitumen content; namely, high grade > 12% bitumen, average grade 9-12% bitumen, and low grade < 9% bitumen. In a better case scenario the oil sands consist of 73% sand, 12% bitumen, 10% fines, and 5% water. This makes clear that the bitumen needs to be separated from the other components going through a primary and secondary extraction process. Water is required to accomplish this, whereby the amount and what state of water is used are dependent on whether open-pit (surface) mining or in-situ extraction is utilized to produce the crude oil. Note, this process requires significant energy generation and it is this fact that eventually determines the amount of CO2 emissions released into the atmosphere.

Nathan Lemphers from the Canadian Pembina Institute (an environmental think tank) gives in a recent article three reasons for the U.S. president to reject the Keystone XL (KXL) pipeline – first and foremost that “given the considerable uncertainty for Pacific-bound or West-to-East pipelines in Canada, approving the KXL pipeline would directly cause increased oil sands production and increased carbon emissions.” This statement is true in the sense that overall emissions will grow as production increases in order to meet a growing global energy demand. However, to be very clear the genuine link here is between supply and demand. Once there is demand, production will adjust upwards in order to meet this demand. Pipeline access is one means of transportation to access market, not the only one and supply will always find a way to reach the market in question. Case in point, there is a significant rise in Canadian crude oil transportation by rail bypassing the pipeline bottleneck at Cushing (Oklahoma) on its way to the U.S. Gulf Coast. Thus, suddenly we have to account for even more CO2 emissions by unnecessarily forcing oil producers to use a more carbon intensive form of transportation while the risk of transporting oil via rail vis-à-vis pipeline is also greater.

Coming back to the extraction process, the so-called “in-situ” mining method produces 2.5 times more CO2 emissions than open-pit (surface) mining because this steam-based extraction method is more energy-intensive. I will familiarize the readers in later blog posts with both extraction methods and their environmental impacts on water, air quality, land and the environment in general. For now, let’s focus on why I believe that we can make a dent in global warming and eventually reduce the emissions from oil sands production with building the Keystone XL pipeline. During my tour, various Government of Alberta officials made very clear that both the regulator and the oil sands industry are committed to developing this natural resource in a “RESPONSIBLE” way. This is illustrated by the fact that the Albertan regulator for the oil sands development – in understanding the potential environmental and ecological impact and trying to strike a balance between societal, economic benefits and the preservation of Alberta’s boreal forest within a pristine natural habitat – has put forth and is now pursuing a so-called “Integrated Resource Management System.” Keywords here are “integrated” which means – given the transboundary character of the issues at hand – that environmental, social, economic impacts as well as impacts on land, water and air have to be addressed at the same time within a “system” — namely within a holistic approach given their interconnectedness. Regulations are already in place: Large emitters must meet mandatory reduction targets as it pertains to CO2 emissions in the oil sands region. “Emitters unable to meet the target must pay $15 per tonne into a clean energy technology fund, which is worth $312 million as of April 2012, or purchase Alberta offset carbon credits. Alberta has reduced emissions by about 32 million tonnes since July 1, 2007.”

This shows impressively that the Government of Alberta is not only “risk-aware” but is forcing or spurring – whichever term you prefer – innovation and ample research and development (R&D) spending to achieve the ultimate goal – responsible resource development. And this is only the government side. The oil sands industry having to work within this regulatory environment has its own incentive: lowering operating costs per barrel of oil produced. In this respect, the corporate culture at Cenovus Energy – an in-situ oil producer – is also very impressive and, in my opinion, exactly what is needed to ultimately reach our climate goals. Greg Fagnan (Director, Production Operations) described the company aptly as a “technology company which also produces oil” given the innovation and R&D within the company along with the constant thinking about e.g. how to use less steam and thus less water and thus less energy and therefore release less CO2 emissions into the atmosphere all while getting the oil (bitumen) out of the ground as efficiently as possible. So, it is all about efficiency. In this respect, it is not only the company’s bottom line that will benefit but the environment and the climate in general because those Canadian companies are actively investing their money into ameliorating the adverse climate effects of their oil sands production.

What is happening in Canada and Alberta should be held up as an example of how to manage a living planet – doing justice to all living species. The Keystone XL pipeline should be approved because part of the revenue generated will be reinvested into R&D to reduce CO2 emissions and mitigate other environmental impacts. Other countries and their oil and gas companies might also benefit from that by being “burdened” with similar regulations. Ask yourself whether conventional oil producer countries exporting to the U.S. such as those mentioned above share the same interest in what the Canadians call “responsible resource development” and whether in their world view the carbon footprint is of any consideration at all. How do we assess a country’s contribution to global warming? Factors such as geography and population are relevant as they relate to overall carbon footprint. Moreover, how efficient is a country at using natural resources? Still, all these questions do not change one fact that the concentration of carbon dioxide in the atmosphere keeps climbing, primarily from the burning of fossil fuels such as oil and coal, according to a recently released UNEP Greenhouse Gas Emissions report. The latest pollution numbers, calculated by the Global Carbon Project (a joint venture of the Energy Department and the Norwegian Research Council), show that “worldwide carbon dioxide levels are 54 percent higher than the 1990 baseline” as Seth Borenstein points out in his article. However, let’s not overlook what familiar names are vying for the top pollution honors according to the 2011 figures for the biggest global polluters:

1. China, up 10 percent to 10 billion tons.

2. United States, down 2 percent to 5.9 billion tons

3. India, up 7 percent to 2.5 billion tons.

4. Russia, up 3 percent to 1.8 billion tons.

…

9. Canada, up 2 percent to 0.6 billion tons.

Please note, that the CO2 emissions problem needs to tackled by all countries equally – especially by those in the top spots. Canada has already taken significant and promising voluntary steps in this direction while moving forward in developing its resource in a responsible way. There is no need to focus in on the Canadian oil sands and its industry, a young industry that is not to blame for where we currently stand from a climate perspective.