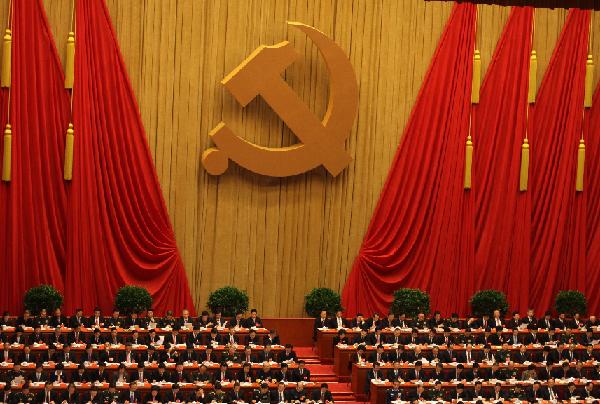

18th National Congress of the Communist Party of China, Nov. 2012 (Source: Wikimedia Commons)

Granting the world’s largest trading nation Market Economy Status (MES) is one of the thorniest issues in Europe right now, splitting the continent and dividing public opinion. Critics of awarding China this rather obscure World Trade Organization status argue it would severely impact governments’ ability to slap anti-dumping duties on cheap Chinese imports. These levies are imposed on goods originating from firms that are unable to prove they operate under normal market economy conditions, but have in fact benefited from government subsidies or other state intervention. If a government believes imports are priced below their real market value, it can apply these tariffs to ensure artificially cheap products shipped in from overseas do not affect domestic firms.

If China were to be awarded MES, EU and U.S. regulators would have a much harder time imposing these duties on cheap imports, potentially putting whole industries and thousands of jobs at risk. MES would allow Chinese companies to flood WTO member states with cheap products, leaving them almost powerless to impose levies to protect their domestic markets. The collapse of Tata Steel’s operation in the UK can be viewed as a cautionary tale of the potential consequences of a MES-empowered China.

According to research conducted by Professor Robert Scott, a director at the Washington-based Economic Policy Institute, as many as 3.5 million European jobs would be at risk if the EU grants China MES. Separately, the European Commission has forecast the loss of nearly 80% of the almost 250,000 jobs in manufacturing industries covered by anti-dumping measures in Italy, Germany, Spain, France, Portugal and Poland if China achieves the status it is pushing for.

The U.S. and the EU are taking divergent approaches to the question of China’s ascension to MES. The U.S. government appears intent on not granting the country the status it feels it should automatically be awarded, while some EU member states are in favor of such a move, notably the UK and Germany.

The debate comes from the fact that China believes it should automatically be granted Market Economy Status (MES) at the end of this year. The country’s government maintains the Protocol of Accession it signed with the World Trade Organization (WTO) in 2001, which currently allows other member states to treat it as a Non-Market Economy (NME), includes a legal obligation that it should be granted MES this coming December, 15 years after the agreement was inked. However, a widely cited paper by Bernard O’Connor, who manages the Brussels office of NCTM, rejects such claims. “There is nothing in the WTO rules, or elsewhere, to provide that China automatically gets Market Economy Status in 2016,” O’Connor writes. “The idea that it will is a misunderstanding shared by many in China, the EU and the U.S.” and that this is “an urban myth that seems to have gone global.”

What’s more, any EU decision to recognize China’s MES would be based not on WTO rules but on Beijing’s ability to meet the five criteria set out in the Union’s own anti-dumping regulations. Among the five, the most important are: Does the government influence the operative decisions of firms or are they made in response to market signals? And does the legacy of the command economy, in terms of public ownership, barter trade and so on, affect firms’ operations? Both the EU Commission and the US Department of Commerce have concluded that Chinese firms “do not operate under market economy conditions and that China as a whole does not meet the technical criteria for MES.”

Indeed, across the pond the picture is clearer and Beijing has even more trouble meeting American standards. For example, Chinese steel was recently slapped with a 265% antidumping duty and regulatory bodies routinely upend Chinese investments in the U.S. What’s more, the deep involvement of the Chinese state in the affairs of Chinese companies is perhaps the most obvious reason why Beijing does not yet qualify for MES.

A great number of Chinese state owned companies (SOEs) looking for American partners have had their hopes scuttled by the Committee on Foreign Investment in the United States (CFIUS), which is tasked with assessing national security implications of proposed mergers and acquisitions. The highly publicized $43 billion tie up between agrochemical giant Syngenta and state owned firm ChemChina could become CFIUS’ biggest casualty to date, as several American lawmakers have explicitly asked the body to investigate and stop the acquisition.

From an EU perspective, China should not be granted MES until it can prove that it satisfies these five key criteria, irrespective of its bleating over the supposed provisions included in its WTO protocol agreement. As long as SOEs harbor suspicious ties to the Chinese state, granting MES to Beijing would be a political mistake. Rather than pushing for an ascension that could wreak unimaginable damage on EU manufacturing and the hundreds of thousands of jobs it supports, China would do well to work towards making sure its businesses are fit to trade with its partners on a fair and level playing field.